– Navigate through the solution for data exchange challenges Loan Management, Accounting, and Payment and Payout Systems have

– Learn about the data types, systems and requires data flows

– Find solutions to optimize microfinance operations

Imagine creating a loan for a client in your loan management system, but forgetting to pay out the actual loan. Alternatively, picture a scenario where a loan repayment occurs, you post it into your loan management system, but you overlook posting it into your accounting system creating inaccuracy.

Maintaining accurate data within systems with busy operations can be challenging. It can potential cause losing overview, chaotic operations and losing money. Sometimes you lose overview, your operations quickly become a mess and you start losing money. While hiring a bookkeeper or accountant can reduce mistakes, it incurs costs and introduces the possibility of errors.

However accurate data is crucial for informed decision-making in your company. Achieving a quick and easy overview of all data is essential. This article is about how to overcome data exchange challenges Loan Management, Accounting and Payment and Payouts Systems have. Let us break it down.

Data Types

A microfinance is dealing mainly with these three data types:

- Loan and customer data

- Accounting data

- Transactional data

System Types

The three systems belows generate, capture and store these three data types.

- Loan management system, keeps track of loan and customer data. For MFIs, your loan management system is basically your key operational system, and used to keep a comprehensive view of loans and customers. It tracks loans per client, total outstanding loans and repayments of principal and interest. It can be a software or Excel sheet, however software is always recommended. If you don’t have such software system yet, understand here how to make the right decision.

- Accounting system (or module); keeps track of accounting data. This can be a separate system or an accounting module within your loan management system. It can be a software or Excel sheet, however software is always recommended. In this article we will refer to accounting system, however it is good to note that in some cases the accounting system is a module of a loan management system.

- Payment and payout system; keeps of transactional data. This is a financial system that enables you to collect payments and disburse payouts to customers. It basically creates transactional data for money coming into your business, for money going out of your business, and data about a balance. It can be a bank, mobile money or specialized payment company, however a solution that creates proper reference is always recommended.

The term “system” encompasses any database or tool utilized for data tracking and executing specific actions. This can manifest as an Excel sheet, software application, or any organized framework tailored to perform distinct functions within a larger process.

It is crucial to note that microfinance operations can easily become “complex” and time consuming to manage operations in an Excel sheet. Therefor (a) dedicated software system(s) is highly recommended, because of the scalability, features, and automation capabilities.

Each system has its unique function, generating and capturing specific data while maintaining a record of this information. If you want to interact with one of three data types, you go to correct system to do so.

It is important to note that there is an overlap, as each system requires certain data from others to operate effectively. For instance, both a loan management system and an accounting system rely on transactional data from a payment and payout system. The accounting system or module relies on data from the loan management system to track interest payments and the total outstanding amount. Moreover the payment and payout system relies on the accounting system to provide information about payouts, after that the accounting system also depend on payment and payout system to ascertain whether salaries, rent, and marketing campaign expenses have been paid.

In essence, the data generated and captured by each system needs to be exchanged among them for seamless operation. In the next chapter we look in detail how the data exchange takes place.

Data Exchange

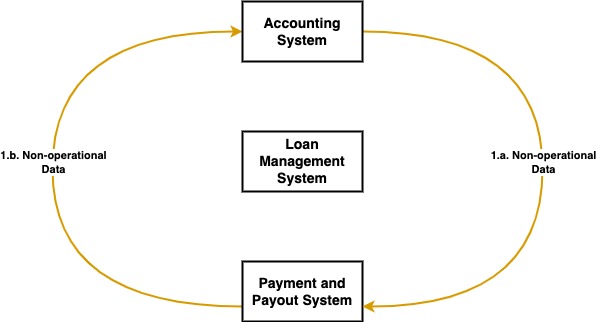

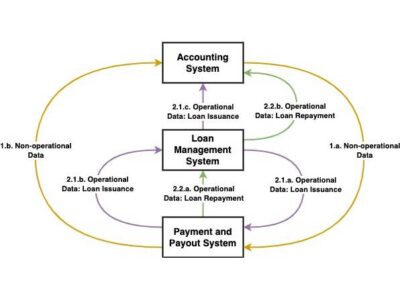

We examine the required data exchange and focus on identifying which system needs to exchange specific data types. The three systems are presented below:.

We elaborate on the required data exchange by looking at the two primary data flow within a microfinance.

- Non-operational data flow (Expenses, cost, investment, think of staff, office, marketing etc).

- Operational data flow

- Loan issuance

- Loan repayment (principal, interest, fees and penalties)

These data flows overlap across the three systems, and once we break them down, it gives us an exact overview of the required data exchange. For each data flow there is an initiated action (input) that creates a result (output). Based on this we will break down what input there is and what output there is and the data created by each input and output.

- Non-operational data flow

Non-operational data includes all the expenses, costs, and investments required to run the company. The data flow involves receiving bills that need payment, and once the payout is disbursed, it is stored in the accounting system. We break it down as follow:- a. Input: Expenses, cost, investment (Staff, office, marketing etc)

- Data Type: Accounting data

- System: Accounting System

- Action: need to be paid out

- b. Output: Expenses, cost, investment (Staff, office, marketing etc) payout is disbursed

- Data Type: Transactional data

- System: Payment and Payout system

- Action: need to go to accounting system

- In a visual representation, it appears as follows:

- a. Input: Expenses, cost, investment (Staff, office, marketing etc)

- Non-operational data flow

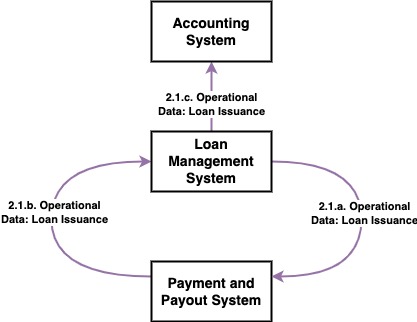

- 2.1 Loan issuance

Operational data as loan issuance, involves issuing a loan to client. The data flow involves the details required to payout to loan such as customer and amount, and once the payout is disbursed, the data is stored has to go to the loan management system to mark it as payout. After that the data goes to the accounting system for accounting purposes. We break it down as follow:- a. Input: Loan issuance including customer and amount

- Data Type: Loan and customer data

- System: Loan Management System

- Action: need to be paid out

- b. Output: Loan issuance payout is disbursed

- Data Type: Transactional data

- System: Payment and Payout System

- Action: need to go loan management system

- c. Output: Loan issuance is marked as payout disbursed

- Data Type: Loan and customer data

- System: Loan Management System

- Action: need to go to accounting system

- In a visual representation, it appears as follows:

- a. Input: Loan issuance including customer and amount

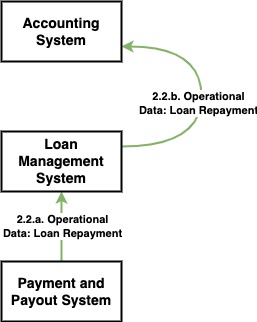

- 2.2 Loan repayment (principal, interest, fees and penalties)

Operational data as loan repayment, involves the repayment of a loan to client. The data flow involves the payment collection of the interest, registration fees, penalties generated on the outstanding loans. Once the payment is collected the data is stored in the loan management system to mark a repayment as successful. Secondly the loan management system identifies what part of the collected payment is principal, interest, fees or penalties. Once that is identified the data goes to the accounting system for accounting purposes. We break it down as follow:- a. Input: Loan issuance including customer and amount

- Data Type: Loan and customer data

- System: Loan Management System

- Action: need to be paid out

- b. Output: Loan payout is disbursed

- Data Type: Transactional data

- System: Payment and Payout System

- Action: need to go loan management system

- c. Output: Loan issuance is marked as payout disbursed

- Data Type: Loan and customer data

- System: Loan Management System

- Action: need to go to accounting system

- In a visual representation, it appears as follows:

- a. Input: Loan issuance including customer and amount

- 2.1 Loan issuance

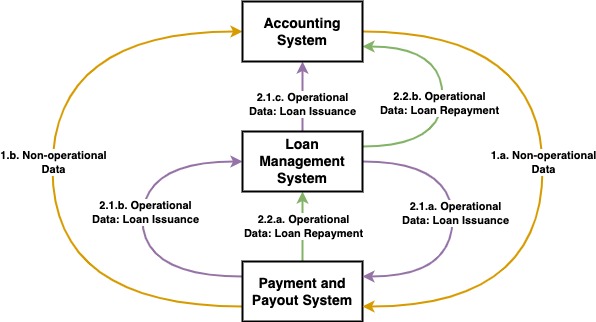

The visual representation of all three data flows appears now as below.

Connection all systems

Now, we dive into the critical aspect of how these data flows work out in practice and address the question of how these systems can collaborate and seamlessly exchange data.

There are two methods to facilitate data exchange between systems:

- Manual Process

- Automated Process

Manual Process

A manual process involves activities like manual importing, exporting, entering, and recording data between systems. Is it feasible? Yes, with a clearly outlined procedure and disciplined execution, there are no issues in adopting a manual process. Below outlines a step-by-step process for each flow, suitable for incorporation into your financial and accounting policy manual.

- Non-operational

- Accounting System: Save the bill and required information

- Accounting System: Mark bill as unpaid

- Accounting System: Copy or export payout details included bill reference

- Payment and Payout System: Enter or import payout details included bill reference

- Payment and Payout System: Make the payout

- Payment and Payout System: Copy or export payout details included payout reference created by the system

- Accounting System: Enter or import payout details included payout reference created by payment and payout system to mark bill as paid

- Operational: Loan Issuance

- Loan Management System: Create and approve loan on a customer

- Loan Management System: Copy or export payout details included loan / customer reference

- Payment and Payout System: Enter or import payout details included loan / customer reference

- Payment and Payout System: Make a payout

- Payment and Payout System: Copy or export payout details included payout reference created by the system

- Loan Management System: Enter or import payout details included payout reference created by payment and payout system to mark loan payout as successful

- Loan Management System: Copy or export loan payout records included loan / customer reference.

- Accounting System: Enter or import loan payout records included loan / customer reference.

- Operational: Principal, Interest, Fees and Penalty Collection

- Payment and Payout System: Copy or export details included payment reference created by the system

- Loan Management System: Enter or import payment details included payment reference created by payment and payout system to mark principal repayment, interest, fee or penalty as successful.

- Loan Management System: Copy or export loan paymeny records included loan / customer reference.

- Accounting System: Enter or import loan payment records included loan / customer reference.

Your payment and payout system can be a bank or mobile money account for disbursement of payouts and collection of payments.

Automated Process

You can also choose to automate the data flow through an integration, which provides several options:

1. Connect/Integrate All Systems

2. Connect/Integrate Loan Management System with Accounting System

3. Connect/Integrate Loan Management System with Payment and Payout System

4. Connect/Integrate Payment and Payout System with Accounting System

Opting for option 1 implies full automation, eliminating the need for the detailed step by step process mentioned above. Alternatively, you can choose one of the other options, reducing the necessity for specific steps. Some loan management software systems already have an integrated accounting module, making option 2 pre-integrated with automated data exchange.

Your payment and payout system, whether a bank, mobile money account, or specialized payment company, can receive funds. Chosen the automated option whereby each system is integrated is in general the best option as it reduces time spending on manual exchanging data, it also eliminates room for error. However regardless of whether you choose for manual or automated processes, the usage of references is within each system applies to both options.

To identify which transactional payout data corresponds to which system, it relies on references. The initiation for a payout originates from the loan management and accounting systems (refer to input). For instance, a loan management system may provide a loan or customer reference, while an accounting system may offer a bill pay reference. It is key to use these references in the payment and payout system during the actual payout disbursement and payment collection. This ensures that you can identify whether to import a transaction record to the loan management or accounting system. When importing a transaction record into one of the systems it is key to use, the payout or payment reference to make sure there is a match.

A Microfinance Accounting Guideline

A Microfinance Accounting Guideline